How to Value a Company: 5 Business Valuation Methods

A company valuation is the process of assessing the economic value of a business. There are many ways to value a company.

In this article, you’ll learn the most common company valuation methods.

1. Market Value Method

This valuation method is appropriate for quoted firms. The market value per share is the price for which the share can be sold on the market. The total market value of the shares of a firm is equal to the number of outstanding shares times the market price per share.

Market Value of Equity = Shares outstanding X Market price per share

The market value of equity is often referred to as the company’s market capitalization.

2. Book Value Method

This method relies on accounting data included in the company’s balance sheet. The book value per share is equal to the total shareholders’s equity, after subtracting the claims of preferred shareholders, divided by the number of shares outstanding.

BV= (Total shareholder’s equity- preferred shares) / Number of ordinary common stock shares

A major disadvantage of this method is the lack of consideration of a firm’s earnings potential.

3. Asset Value Method

The asset value method considers an actual market value that could be obtained if the company’s assets are sold and then calculates the residual value after creditors and preferred stockholders are paid.

The residual value is available for distribution to ordinary shareholders and the value of a share is calculated by dividing the residual value by the number of outstanding common shares. This method does not take into account the earnings potential of the firm.

SEE ALSO: 12 Financial Terms Everyone Should Know

4. Price Earnings Method

This method assumes that a firm’s earnings after taxes are valued in the same way as those of the industry to which the firm belongs. If the industry P/E ratio is obtained, the market value per share is:

Market value per share = Industry P/E ratio x Expected earnings per share of the company

This method is believed to provide a better valuation approach than the book value and asset value methods because it implicitly takes into account the firms’ expected earnings. Earnings per share reflects the current position but does not reflect the future consequences of some expenditures like R&D.

5. Discounted Cash Flow Method

The appropriate model used in valuation is the one that focuses on the cash-flow consequences of the company’s decisions for the future, not just current period, because this is how the investors value the investments.

Discounted cash flow methods have the advantage that they allow us to obtain specific information about the company’s profitability and growth potential.

The most common variations of the discounted cash flow model are the dividend discount model and the free cash flow model.

5.1. Dividend Valuation Method

The dividend valuation model is appropriate for companies:

- that pay dividends

- that have relatively slow and constant growth rate in earnings

- that have relatively constant payoutratio

- that maintain a relatively constant capital structure

- that are expected to continue on to the indefinite future rather than to merge with some other company

This method has two assumptions:

- Time is divided into yearly intervals. All the cash flows associated with an ordinary share are paid annually at the end of each year.

- The risks (business and financial) that accompany a company’s shares are incorporated in the investors’ required rate of return

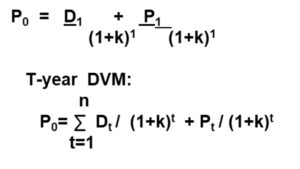

One Year Dividend Valuation Method

Shares are purchased at the beginning of the term and held for one year.

P0 is the intrinsic or theoretical value of the stock as seen today by the investors doing the analysis. It is based on the investor’s estimate of the expected dividends and the riskiness of the dividend stream.

While the market price is fixed and is the same for all investors, intrinsic value can differ among investors depending on how optimistic they are regarding the company. The intrinsic value can be below or above the market value. We think of a group of “marginal” investors whose actions determine the market price. For these marginal investors the intrinsic value should equal the market price.

In a competitive capital market where investors are assumed to share the same accurate information, the intrinsic value of a share is equal to its market price. In such a market, the investors’ expectations about the risk and return associated with the future cash flows from a share determine the current price of a share. Therefore, if the market is efficient, investors can only expect to earn a return commensurate with the risk associated with the future cash flows.

Some important points about the T-year model

1. If a firm pays no current dividends, its share price is not zero because investors believe that either the firm will pay dividends at some future point in time or they expect to realize something which is as good as dividend payments(e.g. capital gains).

2. Since the T-year valuation model calculates the intrinsic value of existing shares, the expected dividends are related to the existing shares only.If the company issues additional shares near the end of the year which are entitled to a dividend payment, then the current intrinsic value should not include the dividends paid to a new share.

Small privately held companies and newly public firms do not meet the specifications mentioned above , so DVM is not appropriate for these firms.Moreover, this model can not be applied to parts of the firm such as subsidiaries and divisions.So a cash flow model for valuing the entire corporation or divisions is developed.

5.2. Free Cash Flow Valuation Method

Free cash flow is the cash flow actually available for distribution to investors after the company has made all the investments in fixed assets or working capital necessary to sustain the ongoing operations.The value of the company is determined by the stream of cash flows that the operations will generate now and in the future.

To judge managerial performance , we must compare managers’ ability to generate operating income with the operating assets under their control.

Value of the firm= Present value(PV) of operating assets + PV of non- operating assets + PV of growth options

= PV of free cash flows + PV of assets at balance sheet values + option pricing model

Present Value of Operating Assets = PV of projected free cash flows + PV of terminal value

The value of the company depends on all the expected free cash flows defined as after tax operating income minus the amount of investment in working capital and fixed assets necessary to sustain the business.

YOU MAY ALSO LIKE: