Futures Contracts – Overview & Basics

Companies should focus on the main business they are in and take steps to minimize risks arising from interest rates, exchange rates, and other market variables.

It is often not easy to remove all the risk associated with price fluctuations. For this reason, companies use futures contracts.

KEY TAKEAWAYS

- They are available on a wide range of assets.

- Specifications need to be defined: What can be delivered, Where it can be delivered, & When it can be delivered

- They are settled daily.

- Closing out a futures position involves entering into an offsetting trade.

- Most contracts are closed out before maturity.

TERMINOLOGY

- Open interest: the total number of contracts outstanding (Equal to number of long positions or number of short positions).

- Settlement price: the price just before the final bell each day (used for the daily settlement process).

- Volume of trading: the number of trades in 1 day.

- The asset: If it is a commodity, quality is specified

- The contract size: The amount of asset to be delivered under one contract

DELIVERY

If a futures contract is not closed out before maturity, it is usually settled by delivering the assets underlying the contract. When there are alternatives about what is delivered, where it is delivered, and when it is delivered, the party with the short position chooses.

SEE ALSO: Derivatives 101: Overview & Types

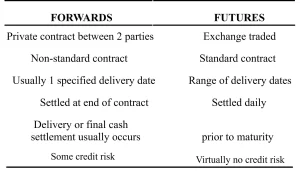

FORWARD CONTRACTS VS FUTURES CONTRACTS

THE BOTTOM LINE

Forward and futures prices are usually assumed to be the same. When interest rates are uncertain they are, in theory, slightly different:

- A strong positive correlation between interest rates and the asset price implies the futures price is slightly higher than the forward price

- A strong negative correlation implies the reverse

Related Topics: