Forward Contracts vs. Futures Contracts: Key Points & Differences

Forward contracts set today the terms at which you buy or sell an asset or commodity at a specific time in the future. Futures contracts are similar to forward contracts in that they create an obligation to buy or sell at a predetermined price at a future date. However, forwards and futures are markedly different contracts by design and by the way they are traded.

Key Points to Understand Forward Contracts:

- A forward contract specifies the quantity and exact type of the asset or commodity the seller must deliver.

- The market is over-the-counter and parties are typically a bank and its customer.

- Transaction costs are usually small.

- Settlement is at maturity.

FAST FACT

Every forward contract has both a buyer and a seller. The term long is used to describe the buyer and short is used to describe the seller. Generally, a long position is one that makes money when the price goes up and a short is one that makes money when the price goes down. Because the long has agreed to buy at the fixed forward price, a long position profits if prices rise.

Key Points to Understand Future Contracts:

- Futures contracts are similar to forward contracts in that they create an obligation to buy or sell at a predetermined price at a future date.

- Futures contracts are essentially exchange-traded forward contracts.

- Futures contracts represent a commitment to buy or sell an underlying asset at some future

date. - They are standardized and have specified delivery dates, locations, and procedures.

Related Topics:

Key Differences Between Futures and Forwards

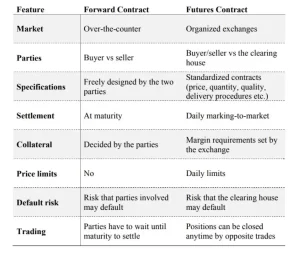

Although they are similar in many respects, forwards and futures are markedly different contracts by design and by the way they are traded. The following table summarizes the major differences.

Forward is trader over-the-counter, which means two party comes together and write a contract. Therefore, forward is very flexible and customized. However, as the buyers and sellers have different needs, the contracts are not homogenous and liquidity is low.

There is also no third-party involved to protect either side from a default risk. Unless otherwise stated in the contract, there is no cash changing hand until the maturity date.

Futures is traded in an exchange. Contracts are standardized, with just a few maturities date available for each good. Because of this, liquidity is higher and it is easier to trade in and out of the market.

Moreover, there is a clearing house which guarantees each side of the trade, therefore there is no default risk to anyone who trades in futures. To protect the clearing house, however, you are required to make a margin deposit, and your position is marked-to-market. Therefore you may be required to pay your loss before the maturity date.

Forward vs Futures Prices

Forward and futures prices are very similar. The theoretical difference arises from uncertainty about the interest on mark-to-market proceeds. However, they may not be equal for two main reasons:

- The net payoff from marking-to-market in futures contracts carries the risk of the term structure of interest rates, which does not exist in forward contracts. This extra uncertainty in futures contracts may be good or bad, depending on the correlation between interest rates and futures prices.

- Forward contracts have an inherent risk of default by counter parties, which does not exist in futures contracts.

The Bottom Line

A forward contract is a commitment to purchase at a future date a given amount of a commodity or

an asset at a price agreed on today. Futures contracts are an exchange-traded, standardized, forward-like contract that is marked to the market daily.

What futures and forwards have in common is the ability to lock in a set price, amount, and expiration date for the exchange of the underlying asset.

This has been a guide to what is the key differences between forward contracts and futures contracts. Here we explain their meanings and key differences. You may also check out these additional topics from Money and Financial Literacy:

- Forward Rate: Definition & Calculations

- Futures Contracts – Overview & Basics

- Options Contract: Overview & Types

- Swaps – Definition & Types