Financial Derivatives: Definitions and Types

A financial derivative is a financial contract whose value depends on the value of an underlying asset. Derivative products are derived from an underlying asset, and they have well defined payoff structures and maturities.

KEY TAKEAWAYS

- With the help of financial derivatives, financial institution managers manage risk better.

- The most important financial derivatives are forward contracts, financial futures, options, and swaps.

- Underlying assets can be equities, interest rates (fixed income), foreign exchange, commodities, credit risk.

- Derivatives can be used to hedge a position.

Financial derivatives are so effective in reducing risk because they enable financial institutions to hedge. When a financial institution has bought an asset, it is said to have taken a long position in case the returns on the asset are uncertain. If it has sold an asset that it has agreed to deliver to another party at a future date, it is said to have taken a short position.

Forward Contracts

Forward contracts are agreements by two parties to engage in a financial transaction at a future point in time.

KEY HIGHLIGHTS

- The market is over-the-counter and parties are typically a bank and its customers.

- Transaction costs are usually small (commissions plus bid-ask spreads)

- Forward contracts can be as flexible as the parties involved want them to be.

- The forward price may be different for contracts of different maturities.

Futures Contracts

The definition of a futures contract is the same as that of a forward contract, in that it specifies that a financial instrument must be delivered by one party to another on a stated future date.

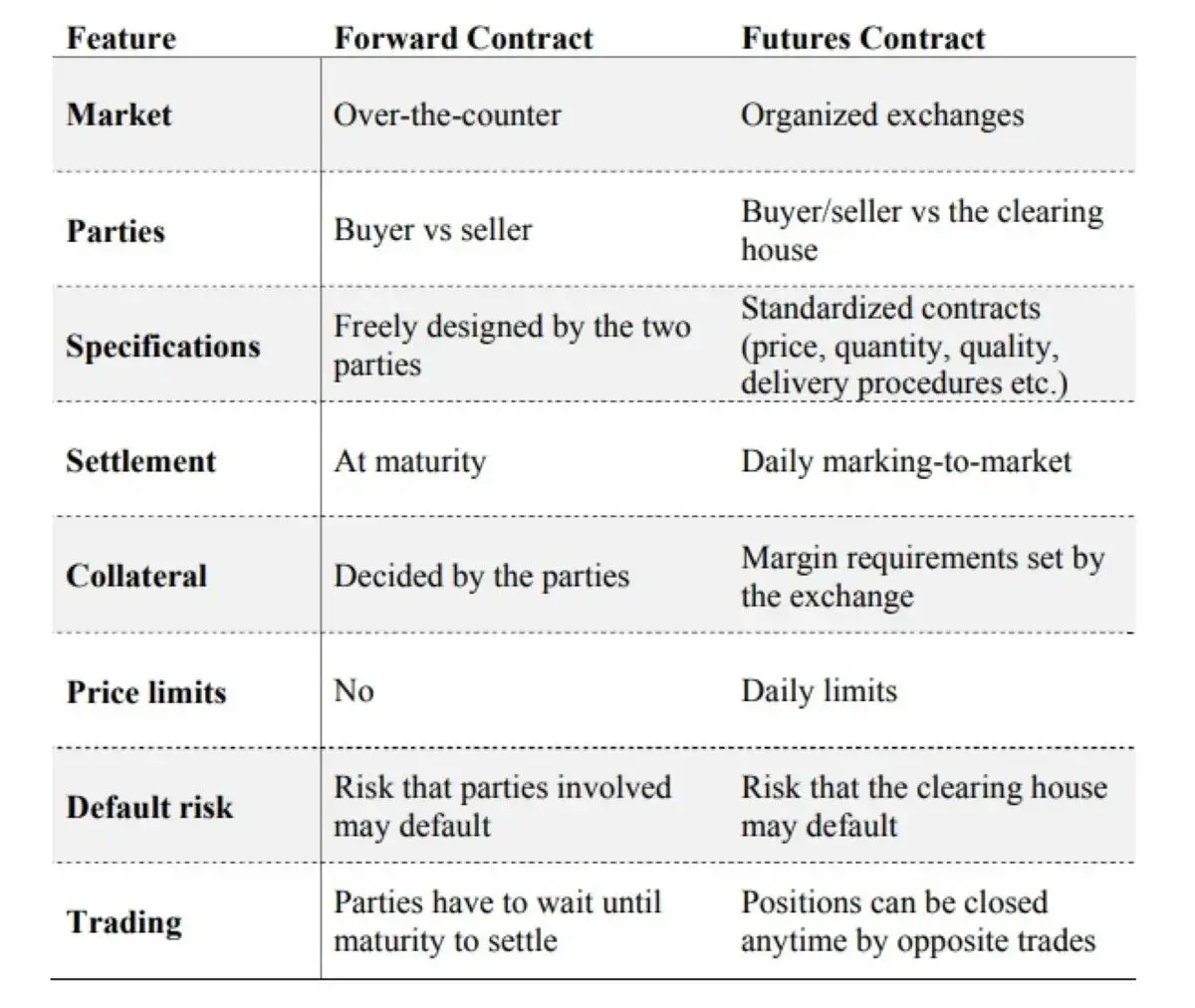

However, forwards and futures are markedly different contracts by design and by the way they are traded. A forward contract is traded OTC, a futures contract is traded on an exchange.

The following table summarizes the major differences.

Key points about futures:

- Available on a wide range of assets

- Exchange traded

- Specifications need to be defined (What can be delivered, where it can be delivered, and when it can be delivered)

- Settled daily

- Mostly closed out before maturity(If a futures contract is not closed out before maturity, it is usually settled by delivering the assets underlying the contract)

SEE ALSO: Financial Statements: Overview of the Three Financial Statements

Option Contracts

An option contract is a derivative product that provides the buyer a right to buy/sell the underlying asset at a certain price, at or during a specific maturity.

There are two types of options – call options and put options. A call option is the right to buy the underlying asset at the strike price on the expiry date. A put option is the right to sell the underlying asset at the strike price on the expiry date.

Price of a call option decreases as the strike value increases. Price of a put option increases as the strike value increases.

There are two main styles of options: American options and European options. An American option can be exercised at any time during its life. A European option can be exercised only at maturity.

KEY HIGHLIGHTS

- Option payoffs are zero-sum. Ignoring the commissions paid to the market maker, the total amount created by issuing an option is zero. The buyer’s profit is the seller’s loss or the buyer’s loss is the seller’s profit.

- Options are cheaper than underlying assets. Hence, they provide leverage.

- A call option is an option to buy a certain asset by a certain date for a certain price.

- A put option is an option to sell a certain asset by a certain date for a certain price.

SWAPS

A financial swap is a contract between two counterparties to exchange, or swap, a series of well-defined future cash flows. Swaps are usually performed between large companies to meet the specific financing requirements.

The most popular types of swaps include:

- Interest rate swaps:The two parties exchange the interest payments on a notional principal. Typically, one side pays a fixed interest rate and the other party pays a floating interest rate

- Currency swaps:A currency swap is a contract to swap a series of cash flows in one currency with a series of cash flows in another currency. Typically, it involves the exchange of both interest payments and also principal.

- Commodity swaps:These derivatives are designed to exchange floating cash flows that are based on a commodity’s spot price for fixed cash flows determined by a pre-agreed price of a commodity.

- Credit default swaps:In a credit default swap contract, the buyer pays an ongoing premium. In exchange, the seller agrees to pay the security’s value and interest payments if a default occurs.

The Bottom Line

Financial derivatives are mostly over-the-counter market products, and used to hedge risks. (On the flipside, they may also be used to speculate to generate profits from them)

A futures and forward contract gives the holder the obligation to buy or sell at a certain price. An option gives the holder the right to buy or sell at a certain price. A swap allows counterparties to exchange cash flows.

DON’T MISS: How to Reach Financial Freedom: These 10 Habits Will Help You to Achieve It